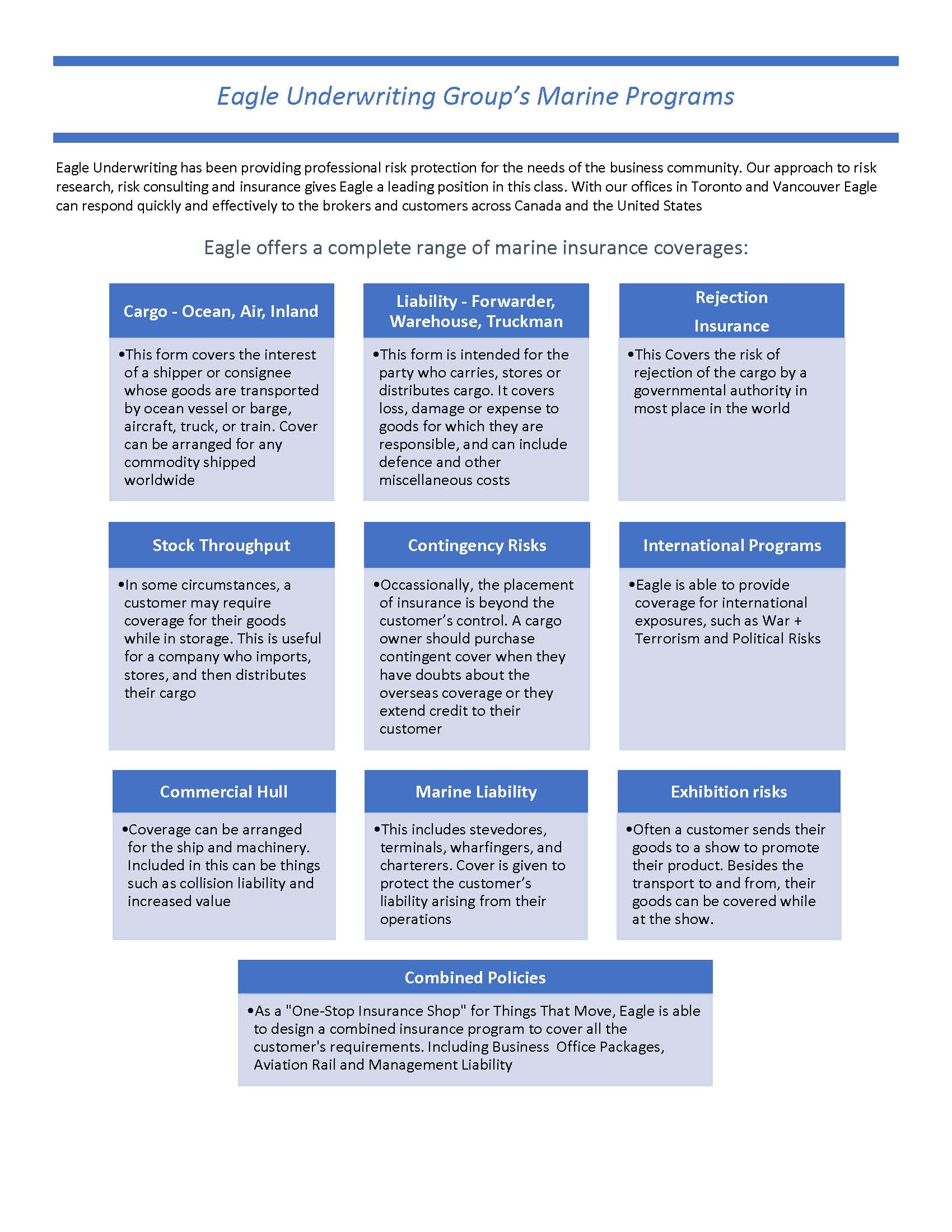

Protection and Indemnity cover is third party legal liability insurance for vessel owners, operators and charterers. Targeting larger yachts, special pleasure crafts, tugs, barges, passenger carrying and fishing vessels.

These legal and contractual liabilities are various in nature and could involve cargo, pollution, people as well as other types of liabilities. We currently write the following classes with limits up to 500 million and 1 billion USD.

Protection & Indemnity Liability

Designed to insure both the contractual and legal liabilities that your client may face as the owner of a vessel. Examples include collision, fines, pollution, general average, wreck removal, death or personal injury.

Charterers’ Liability Insurance

Designed to insure both the contractual and legal liabilities that your client may face as the charterer of a vessel. Examples include loss or damage to cargo, damage to hull, quarantine costs, collision, fines, pollution, general average, wreck removal, death or personal injury.

Additional coverages we also offer are:

Shipowner’s Liability to Cargo

Covers shortage of, non-delivery of or damage to cargo.

Cargo Owners Legal Liability

While Charterers’ Liability provides cover for liabilities in your client’s capacity as a Charterer, this insurance covers legal liabilities to third parties in your capacity as “owner of the cargo” carried.

War Protection & Indemnity

Covers liabilities arising or as a result of a war peril. Examples include crew, pollution and collision.

Hull and Machinery

Coverage for physical loss or damage to vessels of all sizes and types including small harbor-craft, charter vessels, fishing vessels, tug & barges, and ferries. May include increased value, loss of hire, third party collision liability, builder’s risk and war.

Freight, Demurrage and Defense Insurance

Provides cover of shipowners, managers and charterers for legal and other costs incurred in establishing and defending claims which arise out of an event occurring during the period of insurance/entry. A great cover, considered as a proactive loss prevention tool.

Why Choose Eagle?

…Because we value our brokers, offering guidance in each segment. We have the right mix of specialty coverages that enable clients to get the best products and services available. Tailoring our policies to suit your clients’ needs, so that they can grow more effectively.

For more information please contact:

Matthias Cissek

mcissek@eagleunderwriting.com

Tel: (905) 455-6608 ext. 108

Read More